An insurance coverage binder offers temporary proof of insurance protection before the issuance of a formal insurance coverage. Individuals commonly require home and auto insurance binders to supply proof of insurance policy coverage when purchasing a residence with a home mortgage or a new automobile with an automobile car loan (insure). The insurance policy binder defines all the defenses for which you are covered while you wait on a new plan, in addition to any kind of coverage limits, deductibles, charges, conditions.

What is an insurance coverage binder? The definition of an insurance binder is a momentary insurance policy agreement that uses the binder holder completely efficient insurance policy coverage while they wait for the official issuance, or in some cases being rejected, of an insurance plan. Carrying an insurance binder suggests there is a written legal contract between you and also the insurance firm, giving for a specific period of time, normally till a typical plan is provided. affordable.

The expiry date of on insurance binder is generally within 30-90 days of issuance. Upon expiry, the insurance policy binder will certainly no longer proceed to give you with. Many insurance coverage binder types or templates are released by the Association for Cooperative Workflow Research as well as Advancement (ACORD), a nonprofit that supplies insurer with data as well as application requirements.

The insurance coverage binder can help you validate the insurance coverages you have actually obtained are precise and also inevitably validate you are guaranteed. As well as the insurance policy binder can help you confirm the insurance coverages you have actually gotten are exact and ultimately verify you are guaranteed. Finance your residential property You will likewise likely require an insurance coverage binder if you are funding your cars and truck, house or industrial home with a car loan.

If your insurance plan is not offered at the time of car loan issuance, you can supply evidence of insurance coverage to the financial institution or loan provider with an insurance policy binder. low-cost auto insurance. Buy a new house or auto 2 of one of the most typical examples of insurance binder usage remain in instances of buying a home or an auto.

The 6-Second Trick For What Is An Auto Insurance Binder?

Never wait to follow up with your service provider to determine the condition of your insurance coverage, and be certain to request a duplicate of the new insurance coverage agreement if you do not receive one upon issuance - prices.

An insurance coverage binder shows the contract made in between you as well as the insurance provider. It validates in composing that a plan will be provided. The binder is evidence of insurance that you can make use of up until you obtain your actual strategy. It may be provided for a limited time as well as have an expiration date.

It's provided by an accredited rep. A binder is subject to all the terms of the pending contract, unless it is kept in mind otherwise.

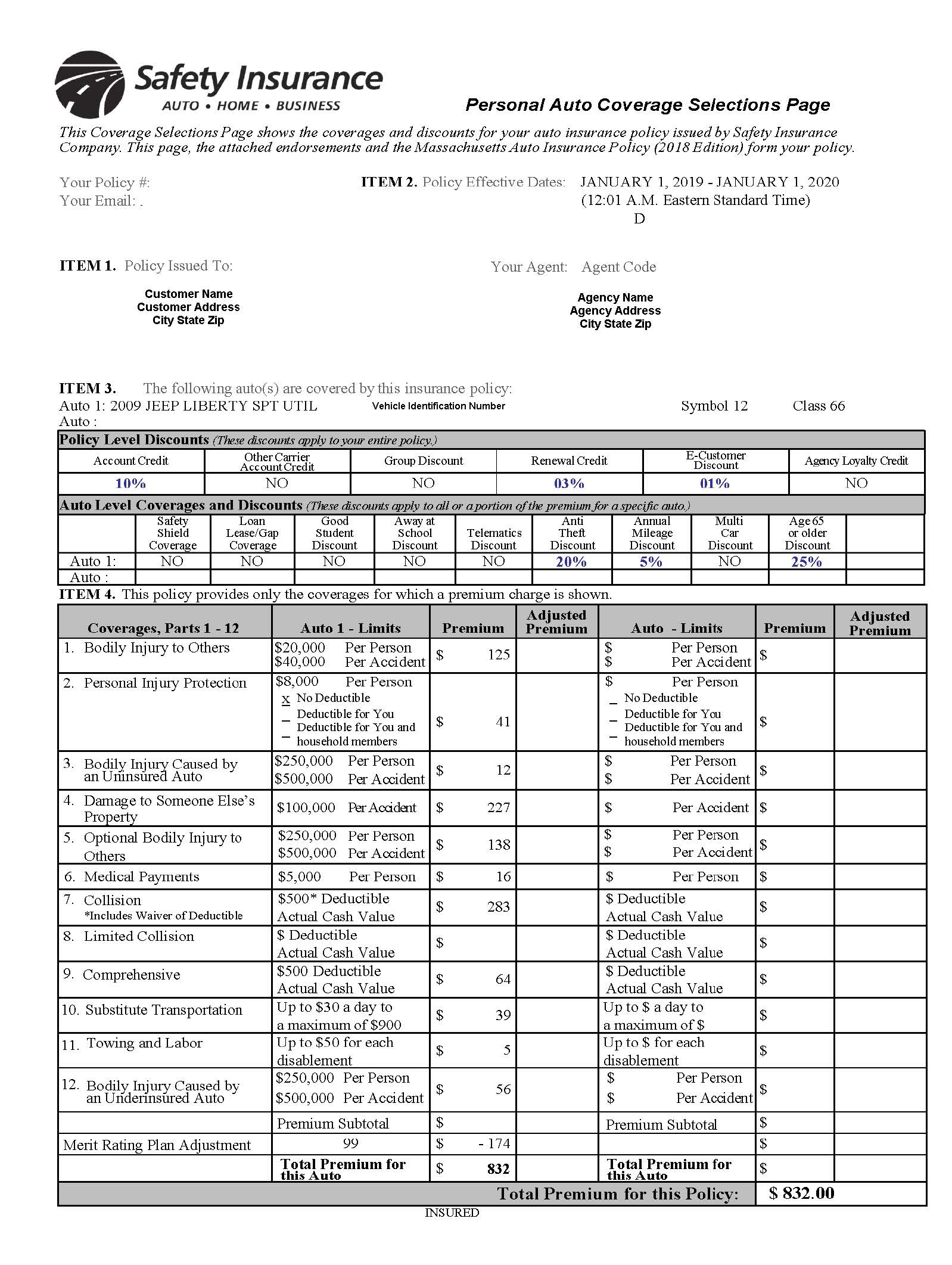

Risk The binder need to plainly mention the risk, or what is insured. It needs to include the cars and truck's make, design, and also automobile identification (VIN) if it's for a car.

Liability The binder should mention the quantity of responsibility insurance policy. It will certainly reveal the restrictions to protection for the named insured(s) as well as the residential or commercial property. Deductibles and also Insurance coverage Limits The binder need to cite the deductible for each and every area of insurance policy on the cars and truck, the residence or property. The kinds of coverage and limitations for each and every must also be stated.

What Does Insurance Binder - Steadily Do?

The Insureds The binder need to name all persons that are guaranteed, as well as any kind of extra insureds. The called insured is often the proprietor of the property. Other insureds could include a co-owner if a residential property is in several person's names. The binder will certainly also detail any mortgagees or lienholders.

The Company The binder need to plainly specify the name of the insurance firm. The Term The binder will clearly determine the term of the insurance coverage: the date the insurance policy goes into impact and also the day when it runs out.

Binders may likewise consist of please notes that will certainly say that it's subject to the terms of the plan phrasing. Who Requirements an Insurance Coverage Binder?

Having the binder will be critical if you need to make an insurance claim before the files show up. Cars And Truck Insurance Binders A car insurance coverage binder is typically used to show that you've insured your automobile. It may be called for by a dealership, a leasing company, or a money business when you're acquiring a brand-new car.

vans low cost auto car cheap car insurance

vans low cost auto car cheap car insurance

Conditions that relate to any finance companies should also show up. Home Insurance Coverage Binders A home insurance policy binder is utilized to show that you have insurance coverage on your house. It's most typically made use of when you're shutting on a brand-new residential property so you can show to the lender or home mortgage firm that the home is insured (cheaper car).

Proof Of Visit this link Insurance - Stcu Fundamentals Explained

He can ignore the binder when he receives the real insurance coverage plan since that will have the full details. An insurance policy binder should be released as soon as you ask for to acquire an insurance policy strategy.

It can take a few days for a company to process all the documentation required prior to a plan is released. The binder is a key part of verifying that you're insured in the meantime - accident.

What If You Never Ever Obtain the Policy? A binder doesn't change it. There might be a significant problem if you haven't obtained your policy before your binder runs out.

Your representative needs to have the ability to arrange the matter out and obtain your plan in your hands within a couple of weeks. Frequently Asked Concerns (Frequently asked questions) How lengthy is a binder great for? The binder should be legitimate for a set term that's written on the record. It's only valid till the real policy papers are published and released.

If you have not received your authorities files, and your insurance policy binder is concerning to expire, you'll desire to follow up with an insurance representative. Health insurance binders are different from the automobile insurance coverage and also home insurance binders discussed right here.

See This Report on The Difference Between A Binder And A Certificate Of Insurance

vehicle insurance insure laws liability

vehicle insurance insure laws liability

All vehicles registered in New Jersey call for 3 sorts of compulsory insurance policy: pays others for damages that you create if you are liable for an accident. It does not cover medical expenses. pays medical costs if you or other individuals covered under your policy are wounded in a vehicle accident.

secures you if you are in a crash with somebody that doesn't have appropriate insurance coverage. Get in touch with your insurance firm for the different insurance policy protection selections or check the Division of Banking and Insurance policy website See a listing of approved firms authorized to write auto obligation insurance in the State of New Jersey.

trucks low-cost auto insurance automobile business insurance

trucks low-cost auto insurance automobile business insurance

In New Jersey, the insurance coverage identifiction card might be presented or supplied in either paper or electronic form. For these objectives, "electronic form" suggests the display screen of images on an electronic device, such as a celular telephone, tablet computer or computer. business insurance. Paper insurance policy card specifications have actually not transformed. You have to keep the card in the car, or be able to produce the digital style: Before an evaluation.

You need to have recently received our "My, Lending, Insurance" welcome letter, keeping in mind that under the terms of your STCU car loan, After 30 days, you have to supply insurance policy on the vehilcle with no lapse in protection or danger breaking your loan agreement. If you do not offer evidence of insurance policy before the 30-day due date, STCU will certainly purchase insurance policy for you at a premium that usually is much more costly than what you could buy on your own (affordable auto insurance).

Below are both easiest means to do it prior to your 30-day target date or any time that your automobile insurance plan could gap: A trustworthy agent can supply the evidence of insurance coverage in a week or less. If it's easier, they can utilize this internet page and also the recommendation number as well as individual identification number (PIN) you offer (see below) to publish your binder.

Get This Report about Insurance Binder Definition - Bankrate.com

You will certainly be required to spend for this lender-placed insurance plan, likewise called "collateral security insurance policy," It is your responsibility to pay for the lender-placed plan, despite the amount of days of insurance coverage it provides, and STCU might additionally bill you for breaking the car loan agreement by allowing your insurance policy gap - insurance companies.

What occurs if I let my lorry insurance policy lapse? As quickly as STCU is informed that your plan has lapsed, we will certainly purchase insurance for the car at a premium that commonly is even more costly than what you could acquire for on your own (automobile). There is and you will be charged the insurance coverage costs for every day that protections is provided.

Insurance coverage is being purchased for me. What should I do? If your insurance policy agent just recently provided STCU with proof of insurance coverage, call STCU promptly to terminate the insurance policy we bought for you. Nonetheless, you will be responsible to pay all premiums related to the moment the policy insured your car.

cheapest car insurance credit vans cars

cheapest car insurance credit vans cars

Ask your representative to offer proof of insurance to STCU, as explained over. When we receive the proof of insurance policy from your representative or firm, we will terminate the plan that was acquired for you. Nevertheless, you will certainly still be liable to pay all premiums applied to the time the policy insured your car.

Your house owner insurance coverage binder will consist of a summary of your house, the address of the residential property you have insured, the kind of residential or commercial property you have actually guaranteed, the name of your insurance provider as well as the protections affixed to your policy. cheaper auto insurance. The Named Insured And Also Loss Payee The "called insured" is going to be whomever possesses the plan this might be an individual or a pair.

Getting The What Is A Car Insurance Binder? To Work

A "loss payee" can be a specific or organization that obtains provided on your insurance coverage as having the first right to any type of cases you may have submitted to make sure that they can secure their monetary interest. Your lender would certainly be an example of a loss payee. They would desire to see to it that if the home was lost because of a protected loss, they would still earn money out on any type of continuing to be home mortgage.

You will certainly additionally find the mailing address as well as call information for both the insurer and your representative (if you utilized one). Details On The Kind Of Insurance policy Plan The insurance policy binder will certainly likewise reveal the kind of insurance policy protection you have on your residence. This can include personal effects insurance policy, basic obligation coverage, loss of usage, clinical responsibility and also other structures insurance coverage.

Made use of to cover things like your laptop computer, garments or any one of your personal items if they are stolen, shed or destroyed as a result of a protected loss. If you have actually a detached garage, a pet house and even a shed, your other structures coverage will certainly look after this. Additionally called medical repayments protection, it generally kicks in to cover clinical expenditures if someone is harmed while visiting your home (low cost auto).